CBO Report Warns Of Long-Term Debt Problems

There's plenty of fodder for deficit hawks in a new report from the nonpartisan Congressional Budget Office. In short, the future looks grim.

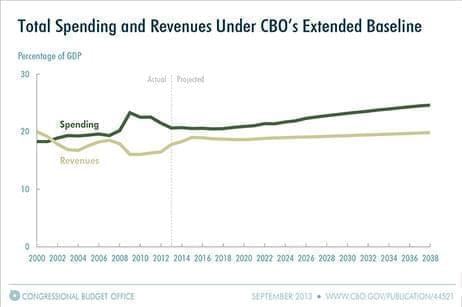

The 2013 Long-Term Budget Outlook finds that although in the short term the deficit is expected to decline, it will grow again — and, ultimately, in a big way.

First, the good news: The CBO projects the deficit will shrink to $378 billion in 2015, or 2.1 percent of the size of the overall U.S. economy. Compared with just a few years ago when the budget gap ballooned as a result of the recession, this marks a nearly unprecedented improvement in the deficit picture. It's a rapid decline in budget shortfalls not seen since the end of World War II. The national debt will bottom out in 2018, at 68 percent of GDP.

"With such large deficits, federal debt would be growing faster than GDP, a path that would ultimately be unsustainable," the report says.

There's actually not a lot new here. The CBO has been projecting long-term debt problems for some time now. Interestingly, the rise in health care costs has slowed recently, but that improving picture was offset by the permanent tax changes put in place by the fiscal cliff deal.

The gap between federal spending and revenues would widen steadily after 2015, according to a new Congressional Budget Office report. (Congressional Budget Office)